Coinsurance is a percentage-based cost-sharing model where patients pay a portion of medical expenses after meeting their deductible. Unlike fixed copayments, coinsurance forces patients to shoulder largely unpredictable and often higher out-of-pocket costs — an approach that disproportionately harms those with the fewest resources and the greatest medical challenges. For many Americans, this system has become an unfair and cruel form of financial oppression, undermining the fundamental purpose of health insurance.

The punitive nature of coinsurance

While cost sharing can discourage overutilization and encourage use of preferred providers or products, coinsurance crosses a line when people who have numerous or complex medical challenges are faced with potentially crushing financial obligations.

This burden becomes oppressive for so many people because coinsurance is typically calculated on list prices, not the lower negotiated rates after rebates and discounts. This forces patients to pay a percentage of an artificially inflated price, often far above what MCOs and PBMs pay. While many plans cap annual out-of-pocket costs, not all do, forcing some patients to make heart-wrenching decisions. From the RAND Health Insurance Experiment, we learned an important effect of coinsurance: the more people have to pay for health care, the less of it they use.

Consider a patient who needs a $100,000-a-year treatment and faces 20% coinsurance. After meeting the deductible, the patient would owe $20,000. For a family earning the median household income of $80,000, the deductible and coinsurance would, after taxes, consume approximately one third of this family’s take-home pay. For too many people, this sort of financial toxicity can make a treatment effectively inaccessible.

For others, access literally becomes a matter of going for broke. In a study of more than 7 million cancer survivors, 42% had depleted their entire life’s assets within two years of diagnosis. A recent KFF/NPR investigation found that 32% of adults ages 18-64 with health care debt had insurance when the debt was incurred. While these analyses didn’t isolate coinsurance’s specific contribution to medical debt, it is likely a major driver of health care-related bankruptcies.

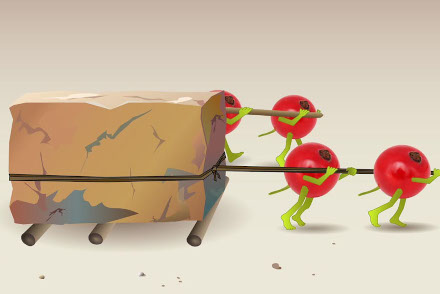

Coinsurance violates the fundamental principle of insurance: spreading risk across a population so that catastrophic losses for a few are distributed across the premiums of many. Instead, the few are forced to pull the weight of a disproportionate share of their plan’s medical costs.

The regressive nature of coinsurance

Coinsurance is inherently regressive — it takes a larger percentage of income from lower-earning households than from higher-earning ones. A 20% coinsurance might be manageable for some patients for some treatments, but it imposes the heaviest burden on those least able to bear it: patients with chronic conditions, rare diseases, or complex medical needs.

Consider two patients facing a 20% coinsurance on a medical procedure that costs $10,000. Both patients owe $2,000, but for an individual earning $200,000 annually, this represents just 1% of her income. By contrast, for a patient earning $30,000 annually, the same $2,000 represents more than 6% of his income — a more significant financial strain.

This burden becomes even more pronounced with higher-cost interventions. If the cost of that procedure were $50,000, the coinsurance would be $10,000. For the higher-income earner, this may still be manageable at 5% of her income. But for the lower-income individual, it exceeds 33% of his annual earnings, potentially pushing him into debt or causing him to forgo care entirely.

High out-of-pocket costs steadily erode people’s disposable income and, presumably, their health. As a result, coinsurance can become increasingly regressive. The lower-income earner watches savings dwindle or debt grow with successive treatments. The presence of a chronic condition could lead to a downward spiral — first, financially, and then in terms of health, as his access to treatment declines with the affordability of care.

Those defending coinsurance often argue it gives patients “skin in the game,” encouraging careful health care choices. But this argument ignores how coinsurance can force those with limited means to make impossible choices between essential care and basic needs. Cost-consciousness should not come at the expense of access to necessary treatment.

The uncertainty of coinsurance

Unlike copayments, which give patients predictable out-of-pocket costs, coinsurance creates significant uncertainty. While patients may know their percentage responsibility, the underlying prices are often unclear or unknown until after treatment. This is especially true when patients require acute treatments with little to no time to inquire about costs or comparison shop, whereas those with chronic conditions have an easier time predicting their out-of-pocket costs. The coinsurance for out-of-network care is even more unpredictable. This uncertainty can cause financial and psychological stress and lead patients to delay or avoid necessary care.

This uncertainty can result in a sense of learned helplessness, particularly when patients are repeatedly unable to predict or control their health care expenses. Instead of coinsurance empowering patients to become savvy health care consumers, the unpredictability of costs may undermine their willingness to shop around. Over time, the overwhelming complexity and opacity of their out-of-pocket costs can make shopping feel futile. Rather than incentivizing consumerism, this form of cost sharing can backfire, leaving patients resigned to accepting high costs without question.

Banning coinsurance or making it more affordable

Two paths forward exist: banning coinsurance at the federal and state levels outright or making it more affordable through income-based adjustments. A complete ban would make out-of-pocket costs more transparent, predictable, and equitable. However, this would increase premiums, making coverage less affordable for some individuals and employers. A ban might also result in overutilization of some care, which could lead to higher premiums.

Alternatively, and more pragmatically, coinsurance could be adjusted for households using sliding scales based on ability to pay and considering factors like household income, size, assets, and medical expenses. While more complex to administer than uniform rates, even an imperfect adjustment would be more equitable than the current system.

Sliding scales have proven successful in other sectors. Many universities adjust tuition based on household income, and other programs (e.g., subsidized rent, energy assistance) make ability-to-pay adjustments. Federally Qualified Health Centers use income-based sliding fee scales for individuals and families with incomes above 100% and at or below 200% of the federal poverty level (FPL). (For context, in 2024, the FPL for a three-person household is $25,820.) The fee scale adjusts for household size, and it sets at least three discounts based on income level.

The growing popularity of coinsurance among payers — who are drawn to its dual effects of proportional cost sharing and utilization control — doesn’t make it just or right. Federal and state policymakers should act, either to ban this practice or make it more affordable. Access to medically necessary care should be a right, not a privilege determined by wealth. The tyranny of coinsurance must end.

No Comments