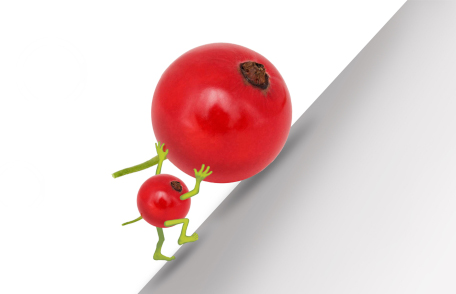

Perhaps you’re familiar with — and sometimes can relate to — the Greek myth of Sisyphus, who is repeatedly forced to roll a huge boulder up a hill for eternity but never reaches the top. For some patients, cost sharing is an uphill battle, as care that is “covered” may be inaccessible because of its out-of-pocket cost. Cost is a well-known barrier that can result in needed care being forgone or delayed until a patient is sicker and costlier — which negatively impacts patients, their families, manufacturers, employers, and government programs.

Estimating and tracking rising out-of-pocket costs would help manufacturers and policymakers more accurately size the problem and, hopefully, develop solutions. But measuring these costs accurately is a heavy lift, thanks to several determinants of cost sharing.

Premiums

Premiums are generally rising (although most premiums for ACA exchanges are declining), and the patient’s cost share varies. Premiums for government programs are easy to calculate. In Medicaid, there is no cost sharing of premiums. So-called “premiums” for Medicare — which are a small fraction of the true premium — are known and rising. For example, rising prices and utilization and contingency reserves for the potential use of the Alzheimer’s drug Aduhelm are pushing Medicare Part B premiums (and deductibles) up.

On the commercial side, it is quite messy. Some people with employer-sponsored care do not make premium contributions, most pay a portion of the premium, and some pay the full amount. Those who buy individual coverage in the exchanges pay the full premium (which is often costlier than the average contribution of workers with single coverage), unless their income qualifies them for premium subsidies.

Deductibles

Deductibles are rising and are variable. For those with employer-sponsored coverage, deductibles are rising faster than wages — 10 times faster than inflation. For employees and their families, it is common to see separate deductibles per person and per family.

Copays and co-insurance

Copayment amounts and co-insurance percentages vary across plans for drugs, depending on plan design. But as drug costs rise, people with a co-insurance benefit design face higher out-of-pocket costs. Further complicating matters, two employers can select the same plan design from the same insurer but set different cost-sharing amounts. For any given formulary, employers may attach different cost-sharing levels to tiers. But reducing the employee’s cost share is like squeezing a water balloon; the other end of the balloon (in this case, the premium) bulges. Making cost-sharing estimates even more challenging, some patients have co-insurance maximums, which are separate from out-of-pocket maximums (discussed below).

Likewise, copays and co-insurance for services vary across plans. Within the same plan, payers often set progressively higher cost-sharing levels for services like:

- Primary care visits

- Urgent care visits

- Specialist visits

- Emergency room visits

- Outpatient surgical care

- Inpatient care

A member’s cost share often varies for these services, depending on whether they are rendered by in-network or out-of-network providers. What’s more, some in-network providers are tiered, with cost-sharing incentives for members who use in-network providers on a specific tier. Some plans have a centers-of-excellence (CoE) program for certain services (e.g., bariatric surgery), and some of these plans lower or waive out-of-pocket costs for patients who use such centers. So, two plans that have what (at first blush) appear to be the same cost-sharing requirements may actually be quite different for select services.

Out-of-pocket maximums

Out-of-pocket maximums further complicate estimates. First, the maximums vary by plan. Second, even if the maximums are known, knowing which patients continue to face cost sharing requires data or, at a minimum, assumptions regarding spend to date during a plan year. Good luck with that!

Discounts

Manufacturer discounts (e.g., copay cards) can lower actual out-of-pocket costs. Drug discounts generally can’t be used with a Medicare prescription drug plan due to the federal anti-kickback law. But manufacturer discounts can apply toward a Medicare beneficiary’s “true out-of-pocket cost” in the so-called “donut-hole” phase if the manufacturer has such an agreement with CMS. These wrinkles add yet more complexity when estimating cost sharing.

Sometimes the out-of-pocket cost is less when a manufacturer discount is used instead of Medicare coverage. Unfortunately, Medicare beneficiaries often miss savings opportunities — not using their insurance likely seems counterintuitive.

Patient-assistance programs

Manufacturers frequently offer patient-assistance programs (PAPs) that help patients in need with out-of-pocket costs — they are financially motivated to do so. Beyond assistance with drug costs, PAPs sponsored by manufacturers, charitable organizations or hospitals may cover other costs associated with care, including transportation, meals, and lodging when travel is required. The use of these programs may need to be accounted for any accurate estimate of actual cost sharing.

Out-of-pocket purchases

Out-of-pocket purchases represent yet another type of cost sharing. In pursuit of savings, some patients pay for drugs and services that are covered at a higher cost share. For instance, for a long list of generic drugs, Walmart charges $4 for a 30-day supply — which is often less than what some people pay for Tier 1 generic drugs. Some patients may use a discount card like GoodRx or purchase over-the-counter drug in lieu of cost sharing for a covered drug. An accurate estimate of total cost sharing would include these purchases. It is important to note that such purchases are a black box to payers because they do not run through payers’ claims-processing systems.

Unless care is free or discounted, the out-of-pocket costs for the same drugs and services are typically much higher for the uninsured than the insured. Often, the out-of-pocket costs for the uninsured are the full price. So, the uninsured often pay more than the insured!

A Sisyphean task

So, how much do people spend on cost sharing? That’s a simple question with no easy answer. But it’s important for manufacturers, employers, and policymakers to know, because if they can’t size up and scope out the problem, then how do they develop efficient and effective solutions? For our fragmented and diverse healthcare system, accurately estimating patient cost sharing is a Sisyphean task. Over time, the boulder gets bigger and the hill gets steeper.

No Comments