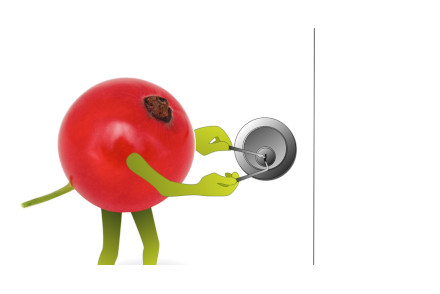

Picking a lock requires a couple tools, time and effort. In essence, pins are pushed out of the way one by one while applying torque. Since the establishment of a Medicare prescription-drug benefit in 2003, Medicare has been banned from negotiating with manufacturers on drug prices. The recently passed Inflation Reduction Act (IRA) picks that lock and moves the first pin in 2026 when negotiated drug prices for the first 10 Part D drugs take effect. More pins follow: 15 additional Part D drugs in 2027, another 15 Part B or Part D drugs in 2028, and 20 more Part B or Part D drugs in 2029 and years that follow.

At first blush, the number of negotiated drugs may seem small and the incremental phase-in may seem slow, but pushing these pins out of the way is significant for two reasons. The first is economic — a relatively small number of drugs account for a disproportionate share of spend (250 drugs account for 60% of Part D spend, and 50 drugs account for 80% of Part B spend). The second, arguably more significant, is political.

The lock

The Part D drug benefit was added to Medicare in 2003 under President George W. Bush through the Medicare Prescription Drug, Improvement, and Modernization Act (MMA). The new drug benefit expanded access to prescription drugs but prohibited Medicare from negotiating drug prices with drug companies. The pharmaceutical industry’s lobbying efforts is largely credited for getting the negotiation ban inserted in the MMA and for keeping it in place up until the recent passage of the IRA.

Make no mistake, the passage of the MMA and the ban on Medicare from negotiating drug prices were both political, not economic. Congress was told the Part D program would cost $395 billion over the first 10 years. Prior to the vote, Medicare’s chief actuary revised the cost estimate to $534 billion but was told by a more senior official to withhold that information. So much for economic analyses informing political decisions!

The Patient Protection and Affordable Care Act (ACA), passed in 2010 under President Barack Obama, required Part D plans to give access to all or nearly all drugs in six protected classes. Unlike the federal government, Part D plans have always been able to negotiate with drug manufacturers, but the protected classes limited their ability to keep some drugs off formulary, and this lessened their negotiating leverage with drug manufacturers. The pharmaceutical industry’s lobbying efforts is also credited for scrapping proposals to remove some drugs from the protected list. Surprise, surprise: All legislative change and lack of change is political in nature.

But the political tide has turned in response to high and rising drug prices. The vast majority of Americans — Democrats, independents, and Republicans — were in support of Congress allowing Medicare to negotiate drug prices. Despite intense lobbying by the drug industry against the healthcare provisions of the IRA, they survived when Congress sent the bill to the president’s desk.

It is important to note that the IRA uses another tool to bend the curve of rising drug prices — it requires drug companies to pay rebates to Medicare if they increase prices faster than inflation for drugs. And to help keep drugs more affordable, the IRA includes other provisions, such as an out-of-pocket cap on Part D drugs, that will reduce Medicare beneficiaries’ costs.

The picked lock

Economists may try to estimate cost savings associated with price negotiations, but the actual savings will depend on: A) which drugs are selected for negotiation, B) the magnitude of negotiated price reductions in excess of reductions Plan D sponsors would have negotiated without the IRA, and C) the resulting utilization. Estimates like these are fraught with assumptions, and the Achilles’ heel is B — estimating the reductions that would have been negotiated without the IRA. This is counterfactual and, as such, unknowable.

But assumptions, including those that are counterfactual, shouldn’t get in the way of budget impact estimates, right? The Congressional Budget Office (CBO) estimated the budgetary effects of lower prices through drug price negotiation separate and apart from other provisions of the IRA (e.g., prescription drug-inflation rebates) for fiscal years through 2031. The CBO estimated a decrease in direct spending of approximately $4.8 billion in 2026, rising annually and reaching $24.6 billion in 2031 — for a cumulative savings of $101.8 billion through 2031.

For many years, pharma companies have warned to great effect that Medicare price controls would stifle innovation. The CBO estimated that, under the IRA, the number of drugs that would be introduced to the U.S. market would be reduced by about two through 2032, about 5 over the subsequent decade, and about 8 over the decade after that. What’s up with those numbers?

Let’s start with the estimated number of fewer drugs. Fifteen fewer drugs over the course of 30 years during which the CBO estimates 1,300 drugs will be approved is a very small number (about 1%). Plus, the CBO notes that the kinds of drugs affected and the effects of forgone innovation were not analyzed. Some of the drugs not brought to market due to picking this lock may have been poorly differentiated me-toos adding little to no value.

As for the CBO’s 30-year estimate, that’s a long time. Tactical plans typically look 1 to 2 years into the future, and strategic plans typically look 2 to 5 years into the future. The CBO notes that the amounts in this estimate are “in the middle of the distribution of possible outcomes” and are “subject to uncertainty.” Well, that’s almost transparent. The fact is that the uncertainty of estimates increases with time. So, the certainty of the 2026 estimate is much greater than the certainty of that for 2032. As for the certainty for estimates for 2052 let alone 2042… forget about it.

The open door

Economists can help estimate the impact of legislation like the IRA before or after passage. Their estimates are better when making short-term forecasts and even better when doing a retrospective analysis. But political scientists stand a better chance at predicting and reflecting upon political outcomes.

Political strategist James Carville coined the phrase “It’s the economy, stupid.” While President Bill Clinton’s 1992 presidential campaign advantageously embraced the slogan to shine a light on the recession under George H.W. Bush, this was a political ploy. In that case, the economy was used as the key to political success.

Economic pressures (e.g., high and rising drug prices) can impact legislation and elections, and legislation and elections can impact economics (lower some drug prices for Medicare), but the votes that pass legislation and win elections are, by definition, political. It’s the politics, not the economics, that picked the lock on Medicare negotiating drug prices. And the picked lock opens the door for more aggressive drug pricing reform in the future.

No Comments